50 years

of providing impartial care in times of crisis

50 years

of assisting the needy, independent of vested interests

50 years

of honouring humanitarian rights through neutral medical care

50 years

of bearing witness to extreme needs amid unprecedented emergencies

50 years

of being transparent and accountable to our patients, donors and the world

We were founded 50 years ago on the belief that everyone has the right to medical care regardless of gender, race, religion, creed or political affiliation, and that people’s health and humanitarian needs outweigh respect for national boundaries. 1971

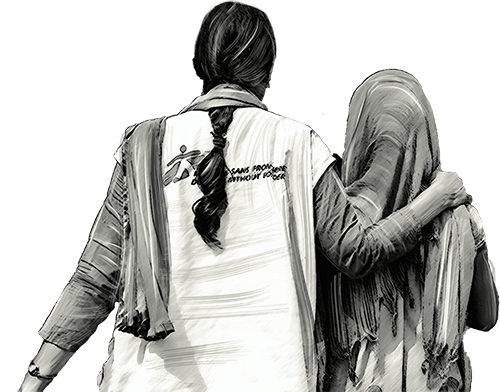

Our medical action is grounded in human-to-human connection. Every day we reinforce our core principle of humanity as we deliver emergency aid to people affected by armed conflict, epidemics, natural disasters and exclusion from healthcare. We refuse to remain silent about the inequities, abuse, violence and neglect that make our work necessary.

Our work is as important today as it was 50 years ago.

YEARS

OF HUMANITY

Stories of endurance:

The MSF

podcast

Listen to true stories of courage, endurance and the sheer human will of people on the frontline of humanitarian emergencies worldwide.

Your act of kindness

can move the world

Speaker: Hello everyone! Welcome to the Market Outlook Podcast. Today, we have with us Mr. Prasun Gajri – Chief Investment Officer, HDFC Life. In this edition of Market Outlook Podcast, he shall be talking about the specially curated insights on equity and fixed income markets. Prasun's monologue: Hello everyone. This is Prasun from HDFC Life with the market update for July 2021. In this update, we look back at the month gone by, discuss & analyse the key economic data and market moves and share with you our thoughts on how the markets are likely to behave going forward. Let me first start by looking at some of the key economic data. Economic recovery post the ebbing of the second wave of pandemic continues. The GST collection for July was over Rs. 1,16,000 crores. While the manufacturing PMI as well as service PMI recovered. Manufacturing PMI for the month came stronger at 55.3, up significantly from 48.1 in the previous month. Services are still lagging but there is a clear improvement with a PMI coming at 45.4, up from 41.2 in the last month. On the tax front, the buoyancy looks good. Overall the tax collections for first quarter, FY 22, are strong with the 2 year CAGR of 12%. All these pointers indicate that the economy is well on the recovery path. The only worrying sign we see is inflation. Both CPI and WPI are elevated, indicating inflationary build-up in the economy. However, we do believe, as does RBI, that most of these inflationary tendencies are transitory, driven by supply side issues and as the time goes by this inflation is likely to come down. However one will have to watch this because a part of this inflation is also driven by high commodity prices and high WPI may eventually feed into CPI. So this is one area where we watch closely. On the trade side, the trade deficit has risen to 11.2 Billion Dollars, led by gradual improvement in domestic demand and increase in commodity prices. Globally too, the growth momentum remains good. However, talks about eventual tapering by the US Fed are dominating the headlines. On the Covid front, caseload continues to be moderate in India. Pace of vaccination has picked up. While there are some concerns on the emergence of third wave, it does seem that the situation is improving. While one will have to be watchful, the trends are looking positive. In this backdrop, Indian equity markets continued their uptrend. As has been the case, mid-caps have been leading the rally, with CNX mid cap index rising more than 3.1% over the month. The mid cap index has in fact risen by more than almost 80% over the last one year. BSE 100 index, in contrast, was up around 6% for the month and has risen around 44% over the last one year. In the last month, the sectors which did well were Metals, IT & Capital goods. Global markets, however, had a mixed month. While US markets did well, the Chinese markets corrected sharply. The news flow was dominated by the crackdown of the Chinese authorities on their big tech companies, especially in the Fintech and the Edutech sector. On the liquidity front, FII's sold around 1.3 Billion Dollars of equities in cash markets. In contrast, the domestic institutions were net buyers of over USD 2 Billion Dollars. The net inflows on the equities funds for the mutual funds continue to be good and July was a very strong month. So given this, the overall liquidity remains reasonably good for the market. On the results front, quarter gone, FY 22 results were largely in line with expectations; the only sector which got significantly impacted was the financial sector where the asset quality issues came back to the fore again, given the deteriorating situation across both banks and NBFC's. Some of the other sectors like IT, Metals & Capital goods, in fact, showed very good results. On an overall basis, we see the NIFTY EPS as well as the broader market EPS being fell in line with expectations, so we are not seeing any major upgrades or downgrades on an aggregate basis now. If you look at the valuations, markets are now trading at roughly over 19 times on FY '23 earnings. This is clearly higher than long term averages. Well, this makes us a little cautious in the short term. The earning trajectory remains intact. Economic recovery is on track and the government reforms are pretty much around. This along with a good liquidity keeps us invested and very positive from a medium to long term perspective as far as equity markets are concerned. Now moving on to the fixed income markets, bond deals rose during the month. The old tenure paper, yield rose to 6.23% while the new tenure paper which was issued at 6.1% also moved up to 6.20%. The market was in fact disappointed by some of RBI's actions, especially related to the way the GSAP trades were conducted. During this phase when the Indian yields were rising, the US treasuries fell sharply to 1.23% from 1.47%. Despite the elevated CPI and WPI inflation numbers, RBI is of the view that high inflation is transitory and growth needs to be prioritised. This has helped to cushion some of the troubles within the debt markets. While we expect RBI to continue to conduct GSAP to temper the rise in yields, the large supply of bond keeps the bond markets nervous, especially when the inflation is also elevated. RBI is also making some efforts to reduce the excess liquidity, the impact of which we felt more at the short end of the curve. Our base case view remains that our yields are moving up slowly, the timing and extent of RBI's actions determining the pace of this rise. However, any economic slowdown on account of third wave remains a risk to our view. That broadly sums up our thoughts on the last month. I will keep interacting with you going forward. That will be it for this month. Thank you everyone. Disclaimers: HDFC Life Insurance Company Limited ("HDFC Life"). CIN: L65110MH2000PLC128245, IRDAI Reg. No. 101. This is a general update by HDFC Life Insurance Company Ltd. ("HDFC Life")and not an advertisement of insurance products. All unit linked policies are subject to different risk factors and the investment risk in investment portfolio is borne by the policyholder. The update provided is our understanding of the current market and we are not recommending or inviting any investment. Please make your own inquiries before investing. HDFC Life and its employees disclaim any liability arising in this regard.©HDFC Life Insurance Company Limited. All rights reserved.

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam